According to a Savills Middle East estimate, just two developers are expected to provide more than half of the new villas and townhouses anticipated to be built in Dubai by 2027. Questions about the future form of the market are beginning to surface as townhouses take up the majority of future supply and new launches focus on a small number of expansive masterplans.

Customers want to know if there is enough variety in terms of location, design, and lifestyle options to keep up with the rate of expansion. Investors are simultaneously attentively observing which communities are only riding the current wave of demand and which are likely to have long-term worth. This paper examines more closely where the next wave of low-rise expansion in Dubai is coming from, what consumers are prioritizing, and which developers are driving it.

Who is delivering Dubai’s next wave of villas and townhouses?

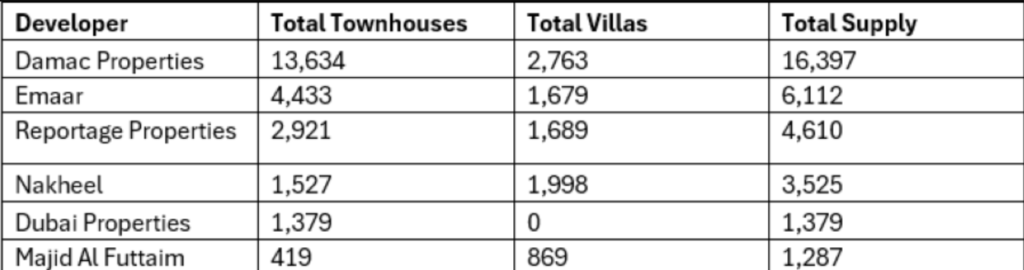

The demand for residential real estate, particularly villas and townhouses, is expected to continue growing as Dubai develops into a major international center for business and tourism. We gathered information from Property Monitor to determine the leading developers ready to provide new units for the remainder of 2025 through 2027 in order to evaluate how the market is preparing to satisfy this demand. The top developers and their anticipated future supply of villas and townhouses are shown in the table below.

- Meeting Demand: The construction of new projects shows initiative in meeting Dubai’s projected population growth, which calls for more housing units. The goal of this new supply is to draw in a varied clientele looking to take advantage of the city’s economic and leisure options.

- Growth and Diversity: Both the number and variety of housing options are priorities for developers. They are placing a strong emphasis on community-focused projects with features that appeal to high-net-worth individuals, families, expatriates, and individuals.

- Infrastructure Investment: Future initiatives will align with upgrades to Dubai’s infrastructure, including better healthcare and transportation. Residential neighborhoods become more appealing as a result, and property values are probably going to rise.

- Impact on the Market Landscape: It is anticipated that the capacity of new units would encourage competition among developers, leading to better residences and creative designs. By maintaining a balanced supply to prevent market saturation, this competition strengthens Dubai’s standing as a leading real estate market.

- Investment trust: The dedication to new initiatives demonstrates the high level of investor trust in Dubai’s potential for long-term growth. It signals a high housing demand and puts the city in a favorable position for both domestic and foreign investors, which eventually boosts the real estate market.

Comparing current vs upcoming supply: Who’s leading the charge?

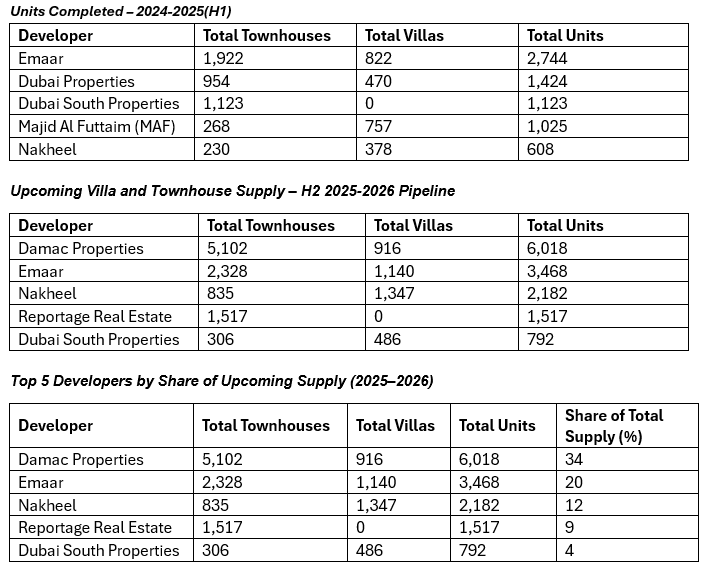

We examined three important indicators to determine who is influencing the next stage of Dubai’s low-rise residential market: the quantity of villas and townhomes delivered between 2024 and mid-2025, the pipeline for the remaining 2025–2026, and the percentage of future supply that each developer will account for.

In the future supply landscape, Damac Properties is becoming the most powerful force. Damac’s strategy displays an ambitious development into the low-rise segment, mainly through townhouses, with 6,018 units scheduled for release, or 34% of the pipeline. Their delivery is significantly centered in the forthcoming period, as seen by the fact that they have no documented completions in the first half of 2025.

With 2,744 apartments finished so far and 3,468 more in the works, or 20% of the future supply, Emaar continues to hold its position as a market stabilizer. Emaar’s position as a dependable presence in delivery and investor confidence is strengthened by this constancy.

With just over 600 apartments built in early 2025 and plans to add 2,182 more, Nakheel is rapidly expanding and nearly quadrupling its output. This indicates a deliberate change in emphasis toward increasing market share in the townhouse and villa segment.

With a 9% market share and 1,517 townhouses planned, Reportage Real Estate is a noteworthy newcomer. Since smaller or formerly specialized players are stepping up to meet demand, their strong upcoming volume, despite no previous completions during this period, illustrates the growing fragmentation of the developer scene.

With 1,123 units scheduled for delivery in early 2025 and 792 more planned, Dubai South Properties seems to be adopting a methodical strategy. Their 4% anticipated supply share points to a consistent, phased market contribution.

Dubai’s residential scene is still shaped by well-known brands like Emaar and Nakheel, but the pipeline data shows that the developer hierarchy has changed. A change toward more varied market participation is evident as Damac currently leads in total volume and Reportage enters the top five. This shift is a result of the low-rise building market becoming more competitive and fragmented, with new companies emerging thanks to townhouse-focused solutions.

Looking ahead: Where the market is headed

Families deciding to settle in Dubai permanently are driving the market for villas and townhouses into a new era of possibility. Developers are making adjustments to satisfy growing demands for long-term investment value and lifestyle. In the future, we can anticipate that new communities will incorporate creative design concepts, encourage multigenerational living, and prioritize wellbeing.

Dubai’s future is increasingly being influenced by low-rise living, thanks to the ambitious launches of well-known developers and the emergence of well planned areas. Townhouses and villas are no longer specialized substitutes. They are quickly taking the lead in defining what it means to live a good life in Dubai. The path ahead has a lot of promise for investors and families alike.

Post Courtesy: Constructionweek