With a central bank housing finance scheme launched on Friday, Pakistanis living overseas will now be able to get their dream house in their home country.

Prime Minister Imran Khan launched the first-of-its-kind initiative for over nine million non-resident Pakistanis and termed it as a game-changer for the country’s economy.

“Overseas Pakistanis are our big assets and we will go all out to facilitate them to invest in the country. Products such as Roshan Apna Ghar under Roshan Digital Account [RDA] will help meet the current account deficit and achieve sustainable economic growth in coming years,” Imran said at the launch ceremony.

His government is working hard to provide a corruption-free system to overseas Pakistanis so that they can come and invest without the fear of fraud and illegal occupation of their properties.

“We have made some good progress on the ease of doing business and will further improve our rankings this year. The ultimate objective is to attract investment from non-resident Pakistanis,” Imran added.

During his speech, Minister of Finance and Revenue Shaukat Tarin said that the innovation of RDA has helped to attract substantial investment of over $1.4 billion in Naya Pakistan Certificates. The Governor praised the State Bank of Pakistan for introducing Roshan Apna Ghar, saying it is another brilliant idea and will attract substantial investment in the real estate sector.

“The Ministry of Finance with the help of State Bank will make every effort to introduce new avenues of investments for overseas Pakistanis,” Tarin said.

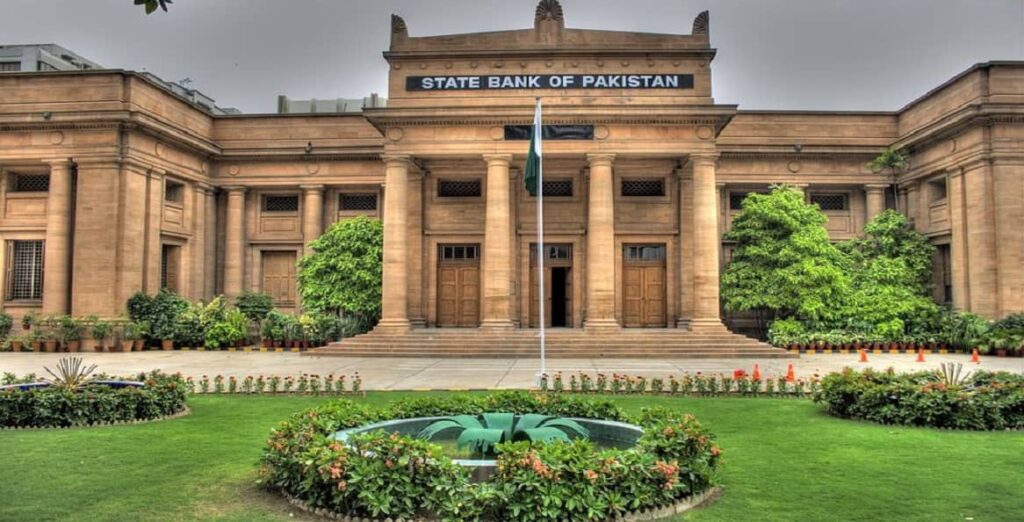

Introducing the new product, Raza Baqir, governor of the SBP, said Roshan Apna Ghar allows non-resident Pakistanis to buy, build or renovate a home in Pakistan through their own investment or bank financing.

“Overseas Pakistanis will be able to complete their transaction completely, remotely, and digitally, and their investment will be fully repatriable,” the governor said. He elaborated that financing is available in both conventional and Shariah-compliant variants at attractive rates for a period of three to 25 years.

“The SBP, with the support of all stakeholders, will continue to bring as much ease as possible for overseas Pakistanis,” Baqir said.

Since its launch in September last year, RDA has connected over 215,000 ex-pats with the country’s banking system and attracted over $2.05 billion.

“It took about eight months to cross the first major milestone of $1 billion whereas the next $1 billion were received in less than four months, which is indicative of the increasing momentum.”

The program is being jointly launched by the finance ministry and the State Bank of Pakistan, the central bank.

Two types of financing are available under Roshan Apna Ghar.

As one option, one may choose either a loan based on liens or borrowing without liens.

Lien-based financing allows NRPs to obtain house financing against their RDA deposit balances or Naya Pakistan Certificates. Banks may finance up to 100 percent of a property’s value for the purchase or construction of a house; for renovation, banks are only permitted to finance 40 percent of the value of the house.

In non-lien-based financing, banks provide financing based on the mortgage of the property being purchased. Financing for the purchase or construction of a house can be up to 85 percent, while financing for the renovation of a house can be up to 30 percent.

Second, under the Mera Pakistan Mera Ghar (Government mark-up subsidy scheme) the house financing facility is available to RDA holders under the Roshan Apna Ghar product, and is subject to already defined criteria under relevant tiers. Financing rates in this case would be the same as those applicable to Mera Pakistan Mera Ghar. Property insurance is also free up to the amount of the loan.