According to a survey by Future Market Insights, the worldwide prop-tech sector is anticipated to develop at a compound annual growth rate (CAGR) of 16.8% to reach $86.5 billion by 2032. In 2022, the amount was $18.2 billion.

Over 10,000 vendors currently make up all startups and more established protect businesses. With 59.7% of all prop-tech businesses worldwide, the United States has the highest stake, followed by Europe (27.2%) and Asia (8%). (3.5 per cent).

In order to contact its consumers digitally, the Middle East and North Africa’s (Mena) real estate industry is also fast modernising. This is a result of more pervasive technological change that has affected all of the region’s industries. The increasing demand for local property from overseas investors is another factor causing change. For instance, Dubai became one of the top vacation spots for wealthy travellers last year as prices in the area’s real estate market rose by 20% to 40%.

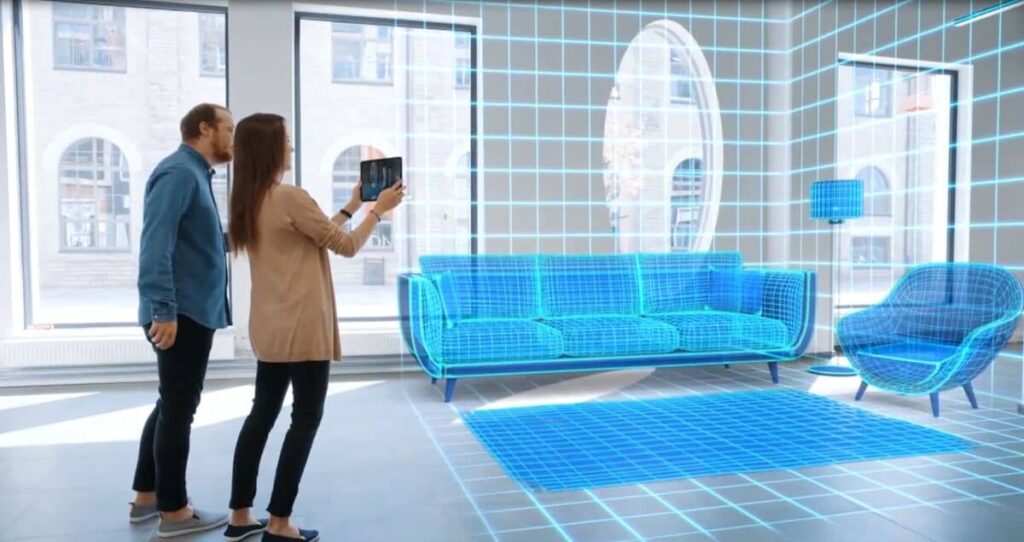

Numerous real estate technologies have the potential to transform the local real estate market. One of these is virtual reality (VR), which enables purchasers to take virtual tours of properties from the comfort of their homes. Another is 360-degree cameras. The metaverse, in which users will be able to trade virtual goods, is another topic of continuing discussion.

The most revolutionary technology, though, is a marketplace where a customer can browse flats and buy them online in a matter of seconds, much like how he would book a hotel through Airbnb.

Last year, the UAE-based prop-tech business Realiste made its debut by bringing this platform to the Dubai market. The site offers direct developer purchasing of off-plan properties with value market reductions.

Realiste, a Russian company, began doing business in the UAE in February 2022. More than 12 advisers, including the vice-chairwoman of the board of Emaar Aisha Bin Bishr, joined the company’s board in less than a year. 27 developers were also partners in the business. The company’s monthly income was close to $1 million by the end of 2022, and it aims to reach $30 million by the end of 2023.

The portal is designed for real estate investors who want to quickly and easily browse the most lucrative properties available worldwide. “The idea was to wake up in the morning, look at all the countries in the world, and understand in seconds which city, or, residential area, or apartment is ripe for investing right now based on data and projections,” Alex Galtsev recalls the history behind creating Realiste.

Investors can currently choose properties from ten cities, including Dubai, London, and New York, utilising the Realiste platform. But throughout this year, the business plans to expand the platform to more than 30 cities.

Realiste’s AI can also predict for clients the future growth of a specific asset and make suggestions for how to manage an apartment in accordance with an investment strategy, such as reselling it in one or two years or renting it out. In addition to matching buyers and sellers, Realiste’s AI can also match buyers and sellers.

Realistic AI has been trained to gather information about the housing market, filter it, and then highlight the most exorbitant and undervalued areas based on that data. Additionally, it may illustrate the pricing history of a specific location or asset and estimate for users how much money they would make investing in a specific apartment in a specific building over the course of one, two, or three years. It can also provide information on the rental yield that their properties will provide.

Realistic used this method the previous year to analyse pricing changes in Dubai from 2022, as well as the areas of the city that experienced the greatest increase and what market participants might anticipate for 2023. For instance, it said that over the past year, the price of real estate in Dubai increased on average by 20 to 40 per penthouse, with properties in Trade Centre First showing increases as high as 210 per cent. According to AI, local prices will rise by 15% nationwide in 2023, with certain regions seeing increases of up to 46%.

Realiste’s technology also revealed that areas like Wadi Al Safa 4, Hessayan First, and Al Yalayis that were unpopular with buyers would experience sharp price increases of up to 46%, while hotspots for 2022 like Trade Centre First, Al Wasl Part 2, and Palm Jumeirah were predicted to experience only moderate price growth.