The latest ‘Oman – H1 2024 Market Overview’ report from Hamptons International Oman indicates that the real estate industry in Oman is growing steadily. This trend is supported by the optimistic economic outlook for 2024, which calls for a targeted GDP growth of 2.1%, up from 1.6% in 2023. By year’s end, the IMF predicts even higher GDP growth of 2.7%, pointing to a rebound from earlier slowdowns.

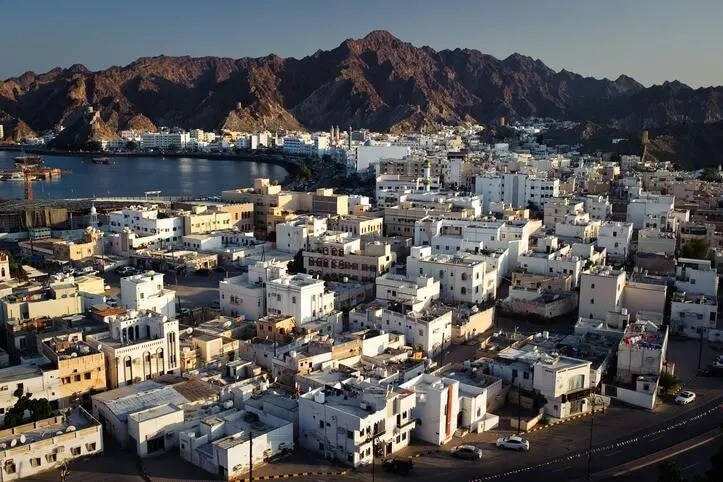

According to the report, Muscat’s real estate market is experiencing a spike in demand, especially for residential properties. The increasing demand for luxury waterfront properties is fueling the expansion of the residential market. From 2024 to 2029, this market segment is expected to grow at a 3.7 percent annual rate, with a potential market volume of $358 billion by that time.

Modern, opulent homes with top-notch features like swimming pools, state-of-the-art gyms, and landscaped gardens are becoming more and more popular with buyers. Additionally, there is an increasing demand for real estate in desirable areas that are close to major shopping, entertainment, and business centers like Al Khuwair and Al Ghubra.

The real estate market in Oman is expanding as a result of several factors. The government’s efforts to draw in foreign investment, like easing restrictions on foreigners’ property ownership and providing tax breaks to developers, have been essential. The allure of the market is increased by investments in infrastructure projects, such as the construction of new highways and airports.

Both local and foreign investors have been drawn to Oman by its strategically diversified economy and stable political climate, which particularly shift the country away from its reliance on oil. Affordably priced mortgages and low interest rates have increased accessibility to real estate purchases, which has increased demand.

The real estate market is significantly shaped by the Greater Muscat Structure Plan 2040. This vision places a strong emphasis on modern, sustainable technology in new projects like The Sustainable City – Yiti, smart city developments like Sultan Haitham City, and economic diversification. The plan aims to address issues like land availability constraints and the adaptability of older buildings, particularly in areas like Ruwi, which is developing into an industrial and logistical hub. The Greater Muscat Plan is centered on combining cutting-edge infrastructure, such as high-speed rail connections and road networks, with recreational areas and public services of the highest caliber.

Real estate trends in Muscat are also impacted by changes in the city’s population. Significant growth is anticipated in the capital, according to the National Centre for Statistics & Information (NCSI), with a discernible shift away from more established neighborhoods like Ruwi and Al Qurum. On the west side, in neighborhoods like Al Ghubra, Al Khuwair, and Airport Heights, expansion is more noticeable. The emergence of new mixed-use and residential complexes, corporate headquarters, hospitality venues, retail malls, and improved public sector infrastructure are indicative of this shift. The vast undeveloped areas set aside for Sultan Haitham City and Al Mabellah are the next stop on the westward development route.

The first half of 2024 has seen a strong increase in real estate activity in Oman, with mortgage contracts at 2,114 and property sales contracts at 6,638 in May, respectively, marking the highest volumes this year. These numbers highlight how dynamic Oman’s real estate market is, driven by both changing urban landscapes and smart economic policies.